What You Need to Know About EPF, SOCSO and EIS as an Employer

As an employer in Malaysia, you are legally responsible for contributing to the Employee Provident Fund (EPF), Social Security Organisation (SOCSO), and Employment Insurance System (EIS) to your employees every month.

In this article, we will cover everything you need to know regarding these statutory contributions.

- Employees Provident Fund (EPF) contribution

Governed by the Employee Provident Fund Act 1991, the EPF is a retirement saving scheme for employees in Malaysia. EPF contributions consist of monthly contributions from both employees and employers. This also includes yearly dividends that are earned. They are managed and invested in either Simpanan Konvensional or Simpanan Shariah.

What are the types of monetary payments subjected to EPF contribution?

✔ Salaries

✔ Unutilised annual or medical leave payments

✔ Bonuses

✔ Certain allowances

✔ Commissions

✔ Incentives

✔ Arrears of wages

✔ Wages for maternity leave, study leave, half-day leave

✔ Other contractual payments

What are the types of payments not subjected to EPF contribution?

✖ Service charges

✖ Overtime payments

✖ Gratuity

✖ Payment in lieu of notices of termination of service

✖ Retirement benefits

✖ Termination benefits

✖ Travel allowances

✖ Director’s fees

✖ Gifts

✖ Benefits-in-kind, and non-monetary perquisites.

What are the employer’s responsibilities on EPF contributions?

Here are several important responsibilities of an employer:

- Registration

Registering with the EPF as an employer within 7 days of hiring the first employee.

- Membership of employee

Registering your employees as EPF members and keeping their information up-to-date.

- Salary Statements

Providing salary statements to your employees.

- Contributions

Collecting your employees’ share of EPF contribution and submitting it to the EPF along with the employer’s share.

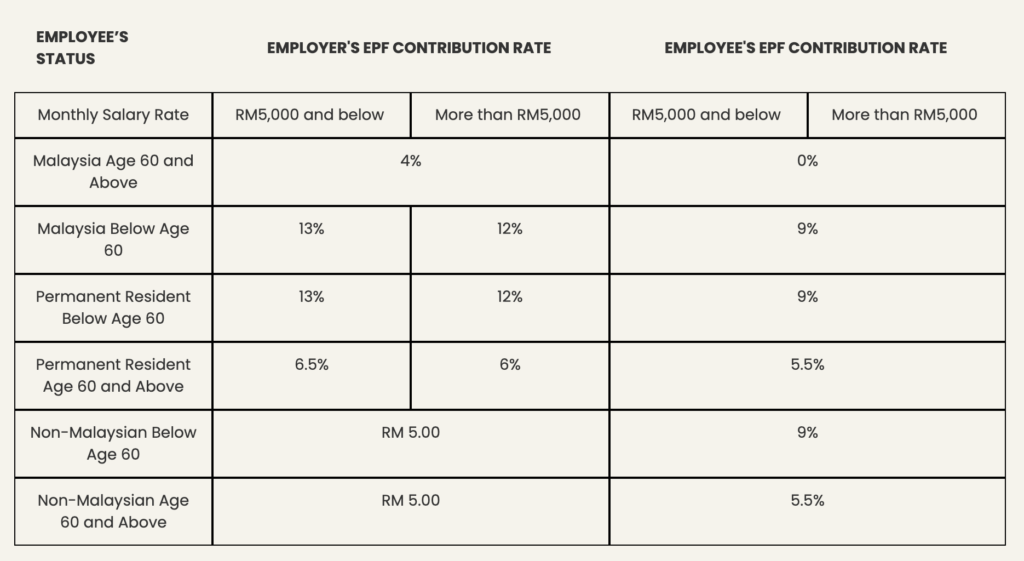

Contribution rate of EPF for employer and employee (as of the year 2021)

As of the Budget 2021 announcement, the employee’s EPF contribution rate for all employees under 60 years old has been reduced from 11% to 9% by default from February 2021 contribution to January 2022 contribution.

Employees who wish to continue contributing at the 11% rate must fill out Form KWSP 17A (Khas 2021), which will then be submitted to the EPF by their respective employers.

The contribution amount should be calculated based on the contribution rate stated in the Third Schedule of the EPF Act 1991, rather than using the exact percentage calculation, except for salaries that exceed RM20,000.00.

When should EPF contribution be paid?

EPF contributions must be paid by the 15th of the month for the previous month’s wages. They comprise both the share of contribution from the employee and the employer.

Do note that failure to make timely payments may result in a late payment fee or dividend.

How to make EPF payments?

EPF payments can be made through the:

1. E-Caruman website or mobile app

2. Internet banking

3. Bank agents

4. EPF counters

- Social Security Organization (SOCSO) contribution

In every workplace, work hazards and accidents are an unfortunate reality whether we want it or not. This is why the Employee Social Security Act is so important to protect both employers and employees.

But who is eligible for SOCSO under the Act?

People who must be registered with SOCSO:

- All Malaysian employees

- Permanent resident employees

- Foreign workers (In effect since January 2019)

People who are excluded from SOCSO:

- Federal and State Government permanent employees

- Domestic servants

- Self-employed

- Sole proprietor or owners of a partnership

The Employees’ Social Security Act 1969 governs two schemes:

- Employment Injury Scheme

- Safeguards employees against occupational accidents or diseases.

- Invalidity Scheme

- Provides insurance for employees who are unable to work. They consist of patients who are incurable or unlikely to be cured of conditions, or even death.

Types of monetary payments subjected to SOCSO contribution:

✔ Salaries

✔ Overtime payments

✔ Commissions

✔ Wages for maternity leave, study leave, half-day leave

✔ Other contractual payments or otherwise

Types of payments that are not subjected to SOCSO contribution:

✖ Any contribution made by the employer towards any pension or provident fund

✖ Gratuity

✖ Any sum paid to cover expenses incurred by the employee in the course of their duties

✖ Bonuses

✖ Travel allowances

✖ Gifts

What are the employer’s responsibilities on SOCSO contributions?

As an employer, your responsibilities on SOCSO contribution include:

- Registration

Registering yourself as an employer within 30 days of hiring the first employee.

- Membership

Registering your employees as SOCSO members and keeping their information up-to-date.

- Reporting

Reporting all work-related accidents that befall your workers within 48 hours.

- Record-keeping

Maintaining a monthly record of your employees’ information and keeping it updated.

- Contribution

Collecting your employees’ share of SOCSO contribution and submitting it to SOCSO along with the employer’s share.

Contribution rate of SOCSO for employer and employee

EMPLOYEE’S STATUS

EMPLOYER’S SOCSO

CONTRIBUTION RATE

EMPLOYEE’S SOCSO CONTRIBUTION RATE

Age 60 and above

1.25% (Employment Injury Scheme only)

0%

Age below 60

1.75% (Employment Injury Scheme and Invalidity Scheme)

0.5%

Foreign workers

1.25% (Employment Injury Scheme only)

0%

The contribution rates listed in this table are not applicable for new employees aged 55 and above without prior contributions – they are only covered under the EIS.

Employees aged 60 and above are exempt from contributing to the employee’s share of SOCSO.

The contribution amount should be calculated based on the Rate of Contribution table on the SOCSO website instead of using exact percentage calculations.

The monthly contribution is limited to a maximum monthly salary of RM4,000.

When should SOCSO contribution be paid?

SOCSO contributions, including both employees’ and employers’ shares, should be paid monthly by the 15th of each month for the previous month’s salary. Any contribution not paid on time will be subject to a late payment interest rate of 6% per year, calculated daily.

How to make SOCSO payments?

SOCSO payments can be made through various channels, including the:

1. PERKESO ASSIST portal

2. Internet banking

3. Bank counters

4. Bank agents

5. Postal services

6. SOCSO counters

- Employment Insurance System (EIS) contribution

Administered by SOCSO and governed under the Employment Insurance System Act 2017, this insurance protects employees aged 18 to 60 who have lost their employment.

However, it does not apply in cases of:

- Voluntary resignation

- Contract expiration

- Unconditional contract termination

- Completion of a project specified in a contract

- Retirement

- Dismissal due to misconduct.

What are the employer’s responsibilities on EIS?

Once you register your employees as SOCSO members, they are automatically entitled to EIS. With this, you have already fulfilled your responsibility as an employer.

Contribution rate of EIS for employer and employee

EMPLOYEE’S STATUS

EMPLOYER’S AND EMPLOYEE’S EIS CONTRIBUTION RATE

Age 18 to 60

0.2%

It’s important to note that the contribution rates presented in the table do not apply to new employees who are 57 years old and above and have no prior contribution.

When calculating the contribution amount, please use the contribution rate specified in the Second Schedule of the Employment Insurance System Act 2017, rather than the exact percentage calculation.

The monthly contribution is capped at a maximum monthly salary of RM4,000.

When to pay EIS contribution?

Both the employee and employer’s share of EIS contribution are paid together with the SOCSO contribution.

Where to make EIS payment?

You can make EIS contributions using the same channels available for SOCSO contributions.

Overview of employer’s responsibilities on EPF, SOCSO & EIS

ACCOUNT

EMPLOYER’S RESPONSIBILITIES

EPF is a retirement savings plan in which both employees and employers make contributions towards the employee’s retirement fund.

- Register with the EPF and provide employee information

- Deduct and contribute employee’s share of EPF contribution from monthly salary

- Submit monthly contributions and other relevant documents to the EPF

- Provide employees with information about their EPF contributions

SOCSO provides social security protections to employees, such as medical benefits and income replacement, in case of employment-related accidents or illnesses.

- Register with SOCSO and provide employee information

- Deduct and contribute employee’s share of SOCSO contribution from monthly salary

- Submit monthly contributions and other relevant documents to SOCSO

- Report workplace accidents and occupational diseases to SOCSO

EIS is an insurance scheme that provides financial assistance and job search support to workers who have lost their jobs.

- Deduct and contribute employee’s share of EIS contribution from monthly salary

- Notify EIS when employees are terminated or laid off

Summary

Being an employer comes with significant responsibilities. As your business grows, managing payrolls and contributions for EPF, SOCSO, and EIS for your employees can be cumbersome, especially when doing it on your own. In addition, it is also important to ensure that your company information is updated at all regulatory bodies at all times.

This is why many business owners engage company secretary firms that offer accounting services to ensure that all necessary documentation and payments are fulfilled in an accurate and timely manner.

If you’d like to learn more about compliance matters with regards to EPF, SOCSO and EIS, you may call us at +6011 63301316, drop us a message on WhatsApp, or send us an email via [email protected].